Brazil's Rock Stars: How the World's Most Diverse Stone Industry Is Carving Its Future

Amagran's Magma blends layers of gold, black and white. Photo: Floor Trends & Installation.

Amagran's Maori showcases layers of black and white in this stunning slab. Photo: Floor Trends & Installation.

Capital Granites & Marbles displayed furniture created from their stones. This one blends emerald, white crystal with dark brown veining. Photo: Floor Trends & Installation.

Capital Granites & Marbles is owned by sisters (left) Moema Lessa and (right) Narjara Lessa who have been in business for 20 years. Photo: Floor Trends & Installation.

Collodetti displayed their new emerald green slabs for viewing and walked everyone through their manufacturing facility, highlighting the cutting process. Photo: Floor Trends & Installation.

The “It’s Natural—Brazilian Natural Stone” program group made up of the trip organizers, architects, designers, buyers, influencers and the trade press pose in front of the new green slabs at Collodetti's facility. Photo: Floor Trends & Installation.

CS3 owns one large quarry that contains a wide variety of stones. There is everything from black and white to dye-injected blue to rust orange like this slab called Maldive. Photo: Floor Trends & Installation.

The group experienced a wide variety of stones in the CS3 facility. Photo: Floor Trends & Installation.

Decolores' Infinity Grey is a quartzite formed by sand layers encapsulating pebbles trapped in a riverbed. Photo: Floor Trends & Installation.

Decolores' Mistic Blue is a greyish-blue quartzite with gold veining and is a popular stone within the vast selection of slabs. Photo: Floor Trends & Installation.

Magban's Blue Velvet quartzite boasts a rainbow of colors— emerald green, rust brown, rich black and pops of white. Photo: Floor Trends & Installation.

Magban's Magblanc quartzite possesses a milky-white palette with thin grey veining—something characteristic of an American market. Photo: Floor Trends & Installation.

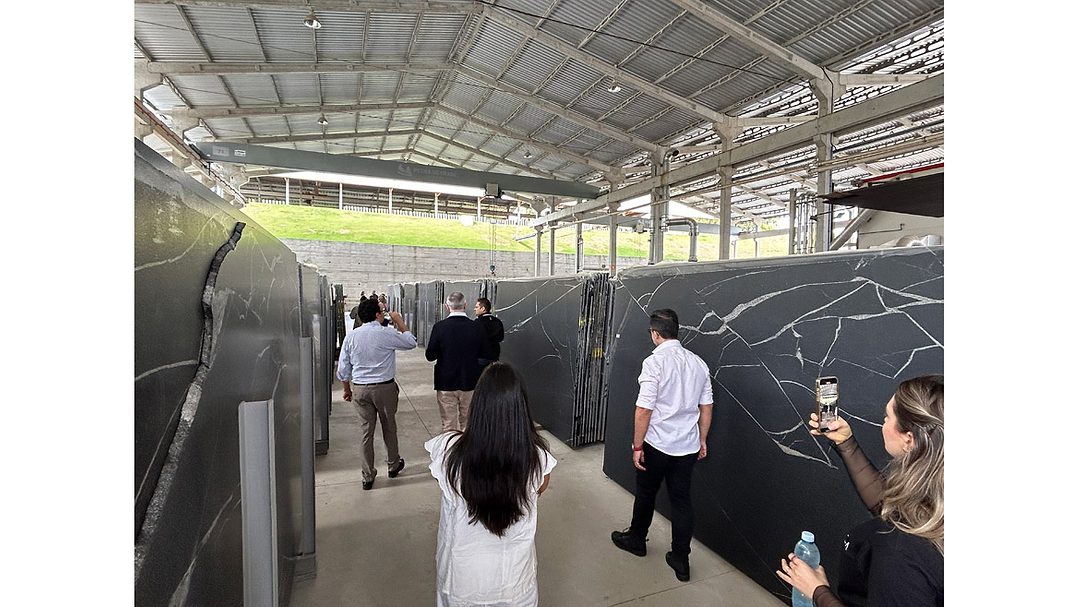

Pedra do Frade's rich black slabs with white veining are their most popular stone with the majority going to the U.S. Photo: Floor Trends & Installation.

Pedra do Frade’s new Natura stone is composed of green quartzite and white quartz, fuchsite and emerald slag. Natura undergoes three applications of coating after it is cut. Photo: Floor Trends & Installation.

Quartzblue Azul Calafate is an example of one of approximately 200 slabs cut per day. Photo: Floor Trends & Installation.

The group got the opportunity to witness the inspection process. Quartzblue, like many other manufacturers, has someone who carefully inspects each slab for cracks and imperfections and makes repairs as needed. Photo: Floor Trends & Installation.

While quartzite is a large part of San Antonio's business, dolomite was offered in some interesting colors. The Michelangelo collection was available in four colors: a creamy white with grey veining, a deep rusty red with white, a rich grey with white and a black that was nearly devoid of veining. Photo: Floor Trends & Installation.

Santo Antonio is a multi-generational business that started as a mining company. Today, Santo Antonio boasts a carefully curated palette of stones in its elegant showroom. Photo: Floor Trends & Installation.

As part of the “It’s Natural” export incentive program agenda, participants interacted with many of the companies selected for the program, like CS3, on the Cachoeiro Stone Fair show floor, getting a second chance to ask questions and view the different stone varieties in both block and finished forms—floors, walls, furniture. Photo: Floor Trends & Installation.

At the Cachoeiro Stone Fair, the group was able to interact with Magban's stones in their finished forms. Photo: Floor Trends & Installation.

In an era where porcelain tiles mimic marble and luxury vinyl planks replicate the look of limestone, Brazil's natural stone industry is reminding the world that nothing quite matches the real thing.

Brazil is the fourth-largest global producer of natural stone and the fifth-largest global exporter, according to reports by Centrorochas—Brazilian Center of Natural Stones Exporters. It is the largest exporter of natural stones to the U.S. responsible for 24.7% of imported materials. It also boasts the largest geological diversity in the world with over 1,200 material varieties. Quartzite remains the most sought-after stone, and Brazil is the largest supplier.

Despite such a long list of global accolades, Brazil’s stone industry is struggling to reach architects, designers and distributors with the vast selection of stones available. As such, Centrorochas in partnership with ApexBrasil—Brazilian Trade & Investment Promotion Agency, as well as other agencies are working with stone manufacturers on initiatives and programs to raise awareness, educate and increase stone exports.

“Even though the stone industry is old, the Brazilian stone industry is [only] 50 to 60 years old,” said Fabio Cruz, vice president, Centrorochas. “That's why you see so many business owners and people who are so friendly with each other because we're all overcoming the challenges together. There are several small to mid-sized companies trying to help each other overcome the challenges we share.”

As part of an initiative to promote Brazilian natural stone on a global scale, the “It’s Natural—Brazilian Natural Stone” program was created three years ago. This year, held in August, it brought architects, designers, buyers, influencers and the trade press from different countries to the heart of the Brazilian stone industry for an immersive experience to learn about Brazil’s stone industry and ultimately, increase exports.

In 2023, the Brazilian natural stone sector exported $1.11 billion, a 13.4% decrease compared to 2022’s $1.28 billion, according to Centrorochas. The U.S. accounts for 54.7% of Brazil’s export market.

Centrorochas reports that for the first half of 2024, Brazil exported $601.7 million in natural stones with the U.S. spending $342.3 million—an increase of 14.75% compared to 2023. In July 2024, exports were up by 7.35% compared to 2023 with a total of $124.8 million. That brings the year-to-date total to $726.5 million—an increase of 8.37%. The U.S. remains in first place; China is second; Italy in third; Mexico is fourth; and the U.K. is fifth.

To further its efforts Stateside, Centrorochas attended Coverings 2024, held in Atlanta, Georgia, exposing a U.S. audience to 62 Brazilian stone suppliers in the “It’s Natural” 15,000 square-foot booth. The firm has plans to attend Coverings 2025, continuing its push to gain more market share within the U.S.

In October, Centrorochas and Marmomac Brazil launched the Brazilian Stone Tour, taking place in California and Texas. Four tour dates offered specifiers and distributors the opportunity to learn about Brazil’s natural stones, where to source it within the U.S., gain CECs and even win a chance for an all-expenses paid trip to Marmomac Brazil in February 2025.

Within the Brazil market, Brazil hosted the 21st Vitória Stone Fair in January 2024 and revealed that the show will be rebranded as Marmomac Brazil and move to São Paolo, Brazil’s largest city in terms of population and its financial center, in 2025.

According to Flávia Milanez, CEO of Milanez & Milaneze, the company responsible for Marmomac Brazil, the stone sector was apprehensive about the rebranding and relocation of the show, but in order to reach a broader audience, the move was necessary.

“They know that this is an important step and the sector needs this new market and new clients and, so now the sector is very happy with this project,” she said.

Celebrating its 35th year, the Cachoeiro Stone Fair hosted around 18,000 attendees and 200 exhibitors, representing five countries—Brazil, China, Spain, Italy and Turkey. As part of the “It’s Natural” export incentive program agenda, participants interacted with many of the companies selected for the program on the show floor, getting a second chance to ask questions and view the different stone varieties in both block and finished forms—floors, walls, furniture.

Brazil’s Natural Stone Suppliers

Decolores is one of the largest exporters in Brazil with 70% of its stone going to the U.S. Bronzite, made of iron and quartz, and Mont Blanc, a milky-white quartzite, are top sellers in the U.S. market, according to Abiliane Andrade, product expert, Decolores.

Andrade pointed to two others that are indeed popular and certainly eye catching. Mistic Blue, a greyish-blue quartzite with gold veining, and Infinity Grey, a quartzite formed by sand layers encapsulating pebbles trapped in a riverbed.

Decolores offers visitors the opportunity to explore its Geological Immersion Room where they can see and experience the formation of the stones that they now mine.

“We have eight different materials; the travertine is Mexican and all of those are Brazilian materials and here you can see how nature created those environments to form those materials,” said Thais Aiolfi, geologist, during her tour of the Immersion Room.

Magban is owned by Tales Machado, president of Centrorochas. The manufacturer sells both blocks and slabs in marble, granite, quartzite and shale from their own quarries. Their Blue Velvet quartzite boasts a rainbow of colors— emerald green, rust brown, rich black and pops of white.

The Magblanc quartzite possesses a milky-white palette with thin grey veining—something characteristic of an American market.

Santo Antonio is a multi-generational business that started as a mining company. Arthur Scaramussa, sales executive, is third generation. He provided a tour of the facility, pointing out that approximately 80% of the company’s 3 cm slabs go to the U.S. market.

While quartzite is a large part of their business, dolomite was offered in some interesting colors. The Michelangelo collection was available in four colors: a creamy white with grey veining, a deep rusty red with white, a rich grey with white and a black that was nearly devoid of veining.

Additionally, book matched white and black stones were on display, showcasing what is possible when it comes to design.

Amagran is a distributor that exports 60% of its natural stone to the U.S. The color options were endless with polished, leather and honed finishes available across a wide selection of stones. Additionally, the company stored all of its 2 cm slabs in one space and its 3 cm slabs in another, simplifying the shopping experience.

There were two stone slabs that stood out. Magma and Maori were stunning with their visible layers of black, white, brown and gold.

Quartzblue started as a mining company, sourcing a blue quartzite that no longer exists. It currently produces approximately 200 slabs per day which equates to 25 slabs per hour. They mine from their own quarries with 80% of their slabs sourced from quartzite. They sell 70% of their slabs to the U.S.

Capital Granites & Marbles is owned by sisters Moema Lessa and Narjara Lessa who have been in business for 20 years. They specialize in curated collections of high-end natural stones which can be viewed in their beautiful showroom where clients can not only view the selections, but also see them applied to furniture, the floor and the walls.

Something new that they are doing to their slabs is adding a mesh backing with 50% more resin applied. This ensures that the slab is reinforced, but what is different is that it is barely visible unlike traditional mesh backings.

There were several stones that stood out, but most notable were the green slabs. One intertwined a variety of earth tones with its rich emerald, and the other was a blend of the emerald and a white crystal with dark brown veining.

Collodetti displayed their new emerald green slabs for viewing and walked everyone through their manufacturing facility, highlighting the cutting process. Another family-owned business, Colledetti specializes in quartzite, marble and granite. The size of the saws used in the cutting process is unfathomable. The group was allowed to observe the saws and even got the opportunity to see them start the cutting process.

According to Marcelo Colodetti, communication manager, prior to the purchase of new cutting machines, it took approximately 30-50 hours to cut one block, depending on the stone type. The stones the group observed being cut were estimated to take about 9 hours to cut all the way through.

Pedra do Frade’s new Natura stone is composed of green quartzite and white quartz, fuchsite and emerald slag. It is mined less than a mile from an emerald mine which explains its rich green color. The stone was located two years ago in June with the first block mined in December. Normally, the first block is discarded due to impurities or imperfections, however, Pedra do Frade was able to utilize the first block from this stone.

Natura undergoes three applications of coating after it is cut. Then, the cracks are filled with the crushed stone to prep for polishing to prevent the polishing machine from hanging up on the edges of the cracks. These steps are performed by hand to ensure quality. Mesh backing is then applied to slabs with cracks or those that are more delicate.

The rich black slabs with white veining are their most popular stone with the majority going to the U.S.

CS3 owns one large quarry that contains a wide variety of stones. They offer everything from black and white to rust orange to dye-injected blue. Additionally, they source synthetic stones from China and process the blocks in their facility in Brazil. The company sells granite, quartzite and marble with 60% of its business going to the U.S.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!